car insurance deductibles vehicle insurance no-fault insurance insure

car insurance deductibles vehicle insurance no-fault insurance insure

You will not be legally enabled to drive up until your SR-22 protection is reinstated. You would need to get SR-22 protection in Missouri and also have it sent to the state that requires you to hold SR-22 coverage. STL Insurance policy Quit can manage this procedure for you. We shop the premier insurance coverage service providers to discover you the cheapest cost SR-22 coverage available.

Your location, driving background, quantity of miles you drive, and also credit history rating additionally go right into identifying your vehicle insurance policy price for SR-22 (insurance group). You might obtain an SR-22 declaring from any type of insurance policy business that provides it.

No. You have to call your insurance policy representative to terminate your SR-22 filing once the designated time is up, otherwise your policy will certainly proceed. ignition interlock. Extra Information.

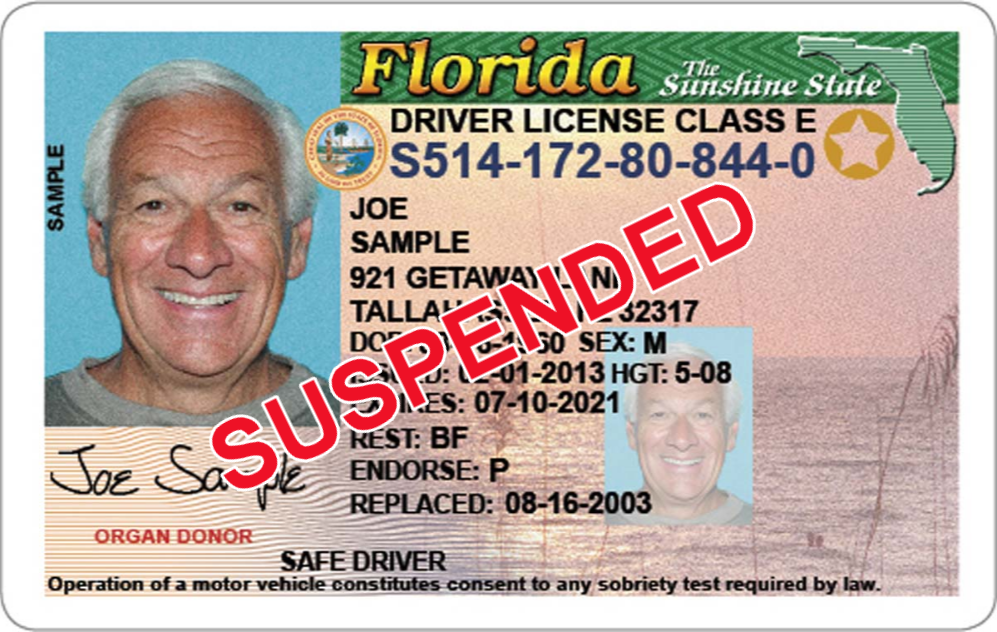

In a lot of cases, filing an SR-22 insurance certificate with the state is the only thing standing in your method of getting your vehicle drivers accredit renewed (sr22). In other instances, there might be extra requirements, such as going to a motorist's course or alcohol awareness courses before you can obtain your permit back.

You can obtain the sphere rolling, nonetheless, by starting the procedure of locating SR-22 insurance policy. Not all insurer supply SR-22 insurance policy, however there are plenty who do, so don't get dissuaded. Also, it's advised that you do some automobile insurance window shopping to make certain you are getting the most effective cost.

What Does Sr22 Insurance Michigan - Blog Mean?

, as far as the cars and truck insurance coverage business is worried. The costly component is the obligation insurance coverage that goes along with being referred to as high risk.

Just how Lengthy Do I Need SR-22 Insurance Coverage? If your insurance coverage lapses or obtains suspended, the insurance firm must notify the Department of Electric Motor Vehicles.

This is quite simple: Call the insurance company as well as allow the agent recognize that you don't need the SR-22 insurance coverage. Then, it will certainly be dropped. Obtain Help with SR-22 Insurance Online Today If you need SR-22 insurance policy, you may really feel a little baffled. You can speak to an insurance agent for help - dui.

Some, but not all, states require you to obtain an SR-22 if your motorist's license has actually been revoked or put on hold as well as you want to drive once again. You might need to have an SR-22 on data for one to 5 years, relying on the state. What Is SR-22 'Insurance policy'? An SR-22 is a document that reveals evidence of financial responsibility in case you're associated with a car mishap.

sr22 insurance sr22 insurance underinsured motor vehicle safety car insurance

sr22 insurance sr22 insurance underinsured motor vehicle safety car insurance

Who Needs an SR-22 Certificate? The rules for when an SR-22 is required vary by state, as well as not all states need drivers to have one. In Texas, for instance, chauffeurs are required to submit an SR-22 with the state department of insurance policy if their permit was suspended because of an auto accident, they have actually gotten a 2nd or succeeding sentence for not having obligation insurance coverage, or a civil judgment has been filed versus them.

The Ultimate Guide To Suspended Driver's License? You May Need An Sr-22 - State ...

Once again, not everybody needs an SR-22. Generally, you may be needed to have one if you: Are captured driving without a license or insurance coverage, Have a driving under the influence (DUI) or driving while intoxicated (DWI) conviction, Have a certificate put on hold due to too much crashes or moving infractions, Owe superior court-ordered kid assistance payments, Incur numerous repeat driving offenses in a brief time structure, Are applying for a difficulty or probationary driving permit Maintain in mind that you might be needed to have an SR-22 on file in the state you're accredited in also if you live and drive in one more state.

Vital If you permit your SR-22 certificate to gap, your driver's permit might be suspended. Some states require insurance provider to alert them when an SR-22 gaps or is terminated. The length of time Do You Need an SR-22 Certificate? The size of time you need to keep an SR-22 certification will likewise depend upon your state's needs.

Or you may need to keep it for approximately five years. Washington state divides the difference and establishes its requirement at 3 years (car insurance). If you require an SR-22, it is necessary to know when the clock begins ticking. The home window of time you're needed to have the certification might start on the day your certificate was at first put on hold.

If you're purchasing a new vehicle insurance plan, you might be able to conserve cash by looking around. driver's license. Tell the insurance company upfront that you need an SR-22, simply to make sure the business provides them. As soon as you have an SR-22 certificate, the insurance provider will file it with the state on your part.

You might require an SR22 filing prior to you can get your driver's permit reinstated. An SR22 is a simply a state filing that is added to an insurance policy.

How What Does Sr22 Mean In Car Insurance? - Answer Financial can Save You Time, Stress, and Money.

The SR22 declaring is an attachment to the car insurance coverage plan. Some companies may bill an easy declaring fee for the SR22Some business will certainly bill a surcharge factor system. Individuals ask us, "How much time do I need to carry the SR22 filing!.?.!?"However, the size of time is determined by the department of car as well as the courts.

In many situations, the court orders a motorist to purchase an SR22 Insurance coverage when that chauffeur has gotten a conviction for unsafe driving. Numerous different offenses might lead to a court order for an SR22. These include: Driving While Intoxicated (DWI,) Driving Under the Impact (DUI,) driving without insurance protection, or having a too much number of website traffic infractions in a short period - sr-22 insurance.

Some insurance companies do not provide this kind of coverage, as it is considered "high threat" insurance. Many local insurance policy representatives can advise a representative that might function with high-risk clients.

For the person that requires coverage to remain on the road, this added price is much more than worth it. We can find the most affordable expense offered. SR22 Insurance Coverage in South Carolina can differ widely from a single person to the next regarding costs. Some elements that might play into the utmost price of the policy normally consist of: The general driving document of the chauffeur, both in the past and also after the conviction: If the sentence were a single thing, the rates would be lower.

The credit report of the vehicle driver: Greater credit rating will typically generate a lot reduced prices, both with normal cars and truck insurance policy and with SR22. The miles driven monthly or year: The fewer miles, the lower the price will usually be. The place: Some locations of the united state have greater criminal offense prices, and also these locations usually have higher insurance coverage prices as well.

Not known Details About Sr22 Insurance Michigan - Blog

Marital status: People that are married typically get an added price cut on their lorry insurance, as they are deemed to be much more mindful drivers.

sr22 sr-22 insurance vehicle insurance insurance insurance coverage

sr22 sr-22 insurance vehicle insurance insurance insurance coverage

The time is usually either six months or one year for ordinary car policies. SR22 functions in different ways since the court normally calls for the certificate to be kept for numerous years.

There can be no gap in protection during the entire plan. If a payment is missed out on or is seriously late, the coverage will certainly become null and gap - sr22 insurance. The insurer is called for by legislation to report any type of lapses in SR22 insurance coverage to the state of South Carolina. This record, referred to as an SR-26, is submitted with the state and the policyholder will then lose their ability to drive.

If a crash is created by the SR22-insured chauffeur and also the minimum coverage is not sufficient to pay the damages, the insured individual may be subject to a suit from the individual that was wounded (insurance). South Carolina additionally calls for all drivers to maintain proof of insurance coverage with them at all times when behind the wheel.

Vehicle drivers with this sort of plan are highly motivated to keep a duplicate of the insurance coverage in their handwear cover compartment at all times. Last Upgraded on January 4, 2022 by Lauren Mckenzie - sr-22.

How Sr22 Insurance - What You Need To Know - David Pope can Save You Time, Stress, and Money.

Any car with a present Florida registration have to: be guaranteed with PIP and PDL insurance coverage at the time of car enrollment. have an Autos signed up as taxis need to bring bodily injury obligation (BIL) coverage of $125,000 per person, $250,000 per event and also $50,000 for (PDL) insurance coverage - vehicle insurance. have constant protection even if the car is not being driven or is unusable.

You need to get the enrollment certificate and certificate plate within 10 days after starting employment or enrollment. You need to likewise have a Florida certification of title for your car unless an out-of-state lien holder/lessor holds the title as well as will not launch it to Florida. Moving Out of State Do not terminate your Florida insurance until you have registered your car(s) in the other state or have actually given up all valid plates/registrations to a Florida - driver's license.

Fines You must preserve needed insurance protection throughout the enrollment period or your driving advantage as well as license plate might be put on hold for up to three years. There are no arrangements for a short-lived or difficulty chauffeur permit for insurance-related suspensions. Failing to keep required insurance protection in Florida may lead to the suspension of your chauffeur license/registration as well as a demand to pay a reinstatement charge of as much as $500.

takes place when an at-fault party is sued in a civil court for problems caused in an automobile accident and also has not pleased residential property damages and/or physical injury demands. (PIP) covers you no matter whether you are at-fault in a collision, as much as the limitations of your policy. (PDL) spends for the damages to other people's residential or commercial property - deductibles.

Does Nevada enable Evidence of Insurance to be offered on a cell phone? Evidence of Insurance coverage may be offered on a published card or in an electronic style to be displayed on a mobile electronic gadget.

How Long Do You Click here for info Need An Sr-22 After A Dui? - Calle's Auto ... Fundamentals Explained

This will additionally tell you whether your automobile enrollment is energetic as well as its expiry day. Why did I receive a confirmation letter? Was I arbitrarily selected? Insurance Policy Confirmation Notifications are never ever arbitrary. Notifications imply we do not have a valid document of your obligation insurance coverage or that there is a feasible gap in the protection.

Typically, this happens when you change insurance policy firms. Exactly how do I respond to the letter? There is no need to check out a DMV office. insurance coverage.

If you have actually maintained continual insurance policy, you will certainly have the ability to enter your policy details. The web site will let you understand if the information you went into confirmed with your insurance provider (insure). If it does confirm instantly, you will obtain a follow up letter allowing you understand the occurrence has been settled.